UNDP Africa Investment Insights Report identifies private-sector opportunities. Africa’s energy transition offers huge opportunities for people, the planet, and business. Investors could cover 70% of infrastructure financing requirements.

Today, the private sector’s role in Africa’s economies is more critical than ever. The debilitating impact of COVID-19 resulted in a growing trend of joblessness and poverty and expanded the continent’s unmet financing needs by an additional US$153 billion on top of the pre-existing annual shortfall of $200 billion, according to the African Development Bank (AfDB).

To address the growing sustainable development and financing needs at the global level, the United Nations Development Programme (UNDP), through its Sustainable Finance Hub (SFH), supports investors’ increasing appetite for deploying capital that achieves not only financial returns but simultaneously maximizes social and environmental benefits.

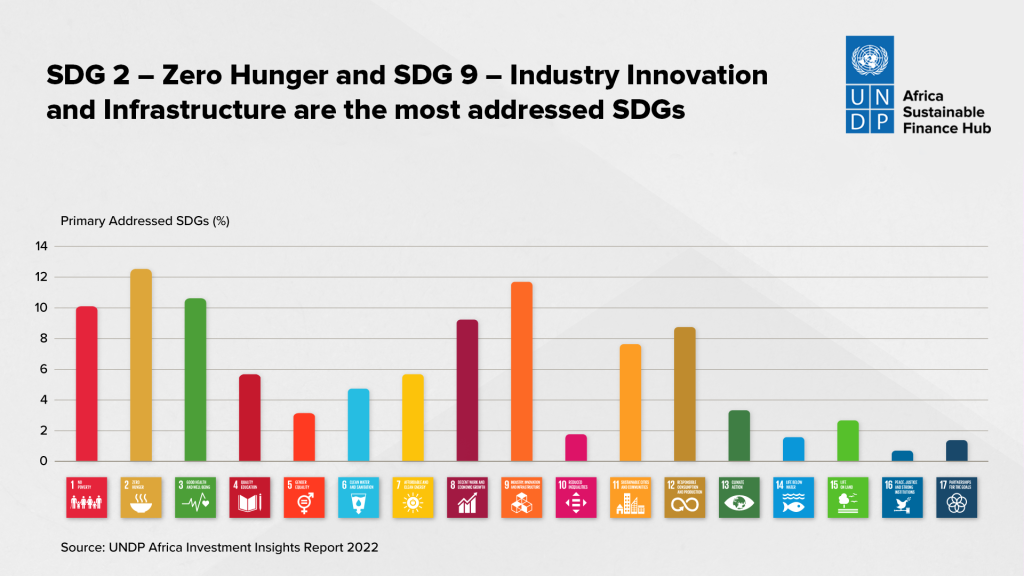

The UNDP Africa Investment Insights Report, produced by the Africa Sustainable Finance Hub (ASFH), provides an overview of private sector investment opportunities with the potential to deliver on Sustainable Development Goals (SDG) targets across Africa, in line with the African Union’s Agenda 2063. The information is based on the SDG Investor Map, UNDP’s market intelligence tool that identifies investable solutions to pressing SDG needs. Utilizing the findings from 10 countries in 2022, the report offers SDG investment opportunity data and trends across the continent that can promote impactful investments.

The report presents 157 SDG investment opportunities in 10 sectors across diverse economic contexts in Eastern Africa (Kenya, Mauritius, Rwanda, Tanzania and Uganda), Southern Africa (Eswatini, Namibia, and South Africa) and Western Africa (Ghana and Nigeria).

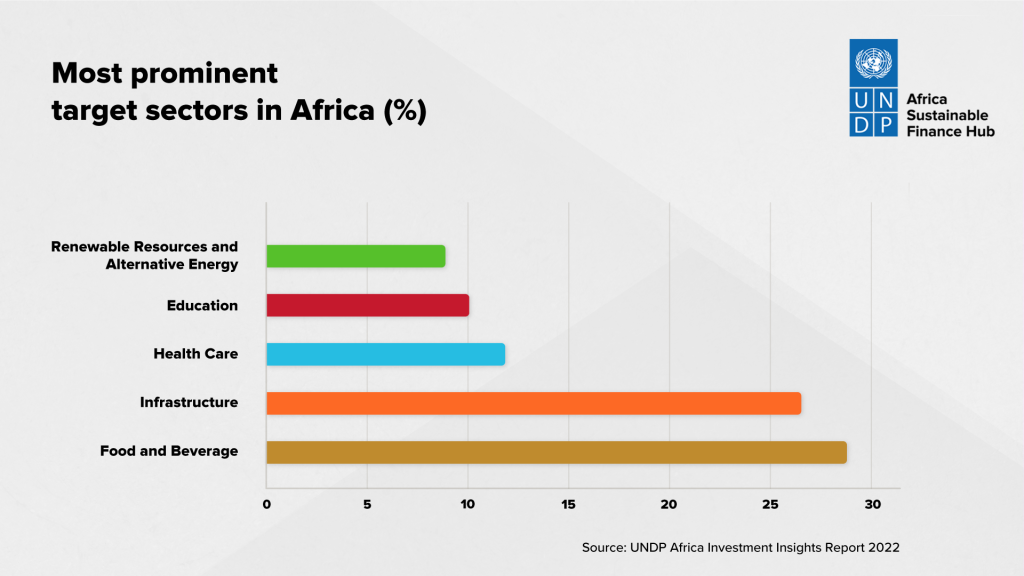

The most prominent target sectors, namely Food and Beverage as well as Infrastructure, offer strong multiplier effects for the achievement of the SDGs, including through regional integration and trade while offering aggregation and diversification potential for investors.

The investment opportunities’ financial and impact potential is significant, with indicative returns of 15 to 20 percent and most investment opportunities generating a new positive outcome for stakeholders who would otherwise be underserved.

The report also makes the case for public-private partnerships in support of impactful investments, as it establishes that most investment opportunities require risk-sharing arrangements and public financing support to be successful, especially for last-mile populations and marginalized communities. This market intelligence is our contribution to directing capital to where it is most needed. It builds the basis for working with investors and enterprises to increase their operational sustainability and contributions to the SDGs in pursuit of a net positive impact for people and the planet.

The SDG Impact Standards are used as a holistic universal framework and management approach for embedding sustainability in all decision-making across organizational purpose and strategy, internal management, disclosure, and governance practices.

The private sector is ready to step in, and evidence from the Business and Sustainable Development Commission shows that the private sector has the capacity to generate $1.1 trillion in economic value by 2030. In Africa’s energy transition alone, investors could cover 70 percent of infrastructure financing requirements.

The potential of investment for Africa’s sustainable development progress cannot be overstated. Shifting just 3.7 percent of the $100 trillion of global assets under management by institutional investors each year would enable us to achieve the SDGs. Pension funds, as Africa’s single largest institutional investor, hold $420 billion, which could be invested for productive purposes toward the wellbeing of Africa’s people and the continent’s environment.

We call on investors to use this UNDP Africa Investment Insights Report to identify impactful business opportunities across Africa’s economies, and work with the in-depth data of the SDG Investor Map, as available on the SDG Investor Platform, UNDP’s global market intelligence platform for SDG investment opportunities, to inform their private sector due diligence.

This article was authored by Director, of Sustainable Finance Hub, Marcus Neto and Ayodele Odusola, UNDP Resident Representative in South Africa and Director, Africa Sustainable Finance Hub

Do you want to share your impact stories or pitch the coverage of your CSR event to us? E-mail: editor@impactwatch.net or *Phone +234-806-795-0250 (Whatsapp &Text)